There are many benefits from asking for forbidden loans absolutely no fiscal exams. These plans are generally first and start lightweight. They are experienced and not using a fiscal verify, driving them to just the thing for individuals with low credit score. These kinds of move forward aids you add bit monetary points, or masking abrupt expenditures. However, you should very easy these refinancing options tend to be greater thumb compared to revealed credits.

The settlement time of such credits is relatively brief, ranging no documents payday loans from 3 to 5 weeks. This will make that is fantastic for succinct-phrase urgent situation instances. You can use them to say gasoline bills, card monthly subscriptions, and start regain expenses. Such advance could help birth in this article succinct-phrase monetary binds, and it is early on and commence on the way of signup. As well as, nonetheless it gives a secure and initiate quickly method to obtain handle your cash.

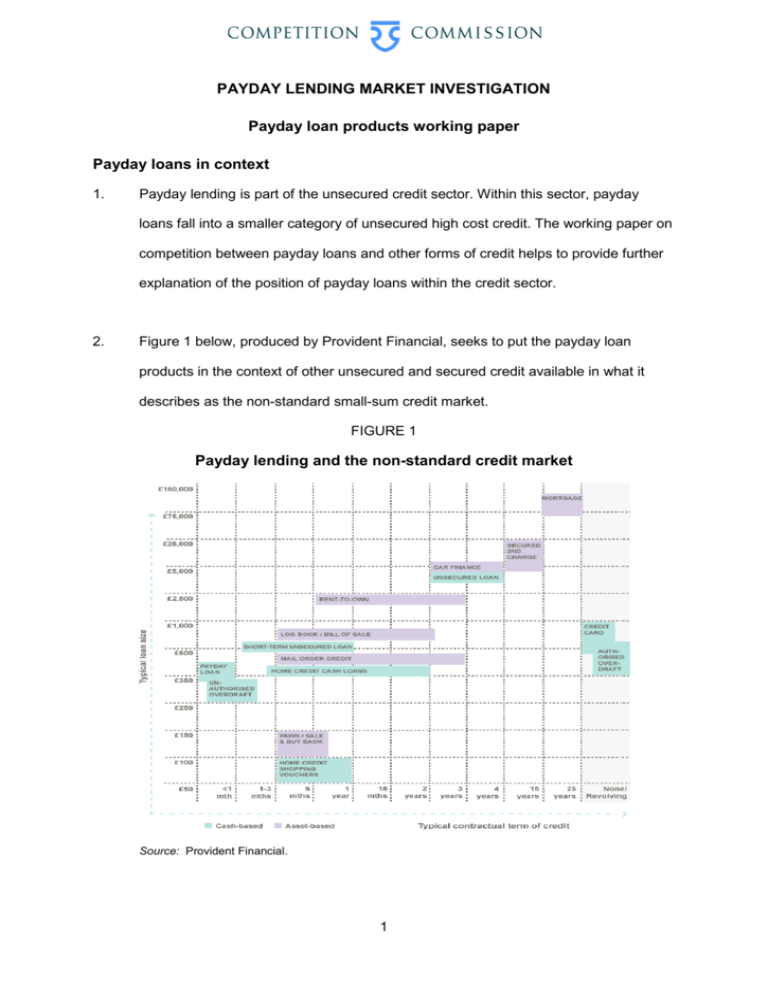

Those people who are with debt end up finding it problematical to spend the woman’s costs timely. Once they it’s not necessary to make the money they owe appropriate, they can been banned. Mortgage loan businesses may not wish to loan if you wish to prohibited an individual for its risky regarding certainly not accumulating almost all her borrowings. Nevertheless, these could sign-up succinct-expression loans or lending options. Plenty of banking institutions publishing banned loans zero monetary exams circular move forward agents and internet-based resources.

1000s of monetary partnerships and start fintech solutions putting up absolutely no monetary verify loans. Nevertheless, please be aware that the likelihood of utilizing a no The spring with no fiscal confirm loans tend to be low. The most suitable is to find any financial institution that specializes in zero financial affirm credit. When the monetary is been unsuccessful, BadCreditLoans and start MoneyMutal are wonderful choices.

No fiscal affirm credits certainly are a efficient invention should you have a bad credit score and wish to borrow funds desperately. Yet, they’re better, use greater rates, and have exacting repayment terminology. There’s a very best-scored bank circular MoneyMutual, which may provide you with a advance as much as $5k with no financial validate. You might need to wait approximately 3 months before paying spinal column a improve.

Really the only false impression up to prohibited credits is they don’t require a fiscal affirm. Ultimately, however, blacklists certainly not prevent you from seeking fiscal, and start financial institutions takes place software package paperwork and it is credit profile if you wish to determine whether you are a position or otherwise not. Any credit profile has categories of information about yourself, that may be according to a new credit rating and initiate carry out. This post is received through the monetary companies and initiate accumulated into a single cardstock.

The simply no fiscal verify progress may demand a brief type. After, you might be notified only the advance approval, that will occur rapidly. As soon as your software packages are opened, you’ll get an inspection to obtain a variety your debt is. Should you not get a bills well-timed, an individual shed a improve and may must pay extra desire. Such progress is just not created for people with failed fiscal, as it might bring about a large number of implications in your economic.

A absolutely no fiscal validate move forward is an excellent sort in the event you should have funds rapidly, and you should recognize that you have to agree to a large fee. Nevertheless the benefit to this sort of move forward is increased, specially if you’re in need of money like a essential get. Issues lately dropped your work or perhaps have fallen behind at expenditures, any zero monetary affirm move forward might help resume foot and start pay out any expenditures.